Navigating China’s Digital Landscape: 5 Common Technical Mistakes Western Businesses Make

China’s digital market offers immense opportunities for foreign businesses, boasting over 1.1 billion internet users and significant digital economic growth. However, this high-reward market is characterized by unique regulatory complexities and a distinct digital ecosystem. Success hinges on deep localization and stringent adherence to evolving regulations, as China’s digital market is a national strategic priority with continuous legislative and enforcement efforts in cybersecurity, data protection, and content control.

I. China Digital Market & User Behavior Overview

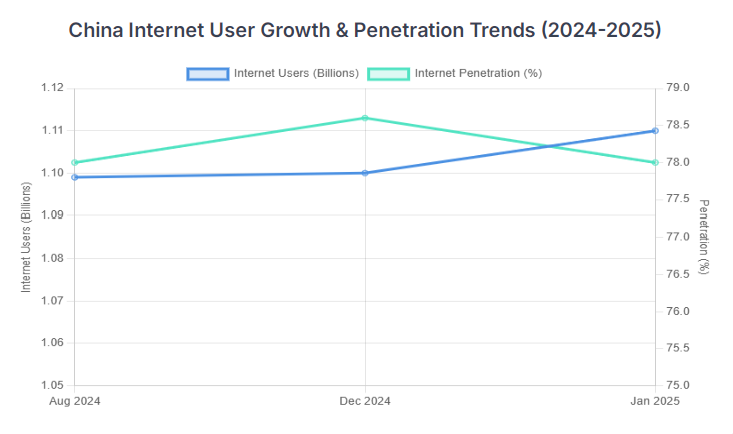

Internet Penetration & User Growth

By early 2025, China’s internet user base reached 1.11 billion, with a penetration rate of 78%. This maturing market means future growth will increasingly come from deeper engagement of existing users and reaching underserved rural and elderly populations. Foreign enterprises should shift strategies from pure user acquisition to retention and value-added services, with tailored approaches for emerging online demographics.

Mobile Internet Dominance & Device Usage

With nearly universal mobile internet usage (99.7% of users access via mobile, 1.87 billion mobile connections), a mobile-first strategy is critical. Super apps like WeChat (over 1 billion users), where many users rarely leave the application, necessitate foreign businesses to prioritize integration within these dominant ecosystems, leveraging built-in functionalities like WeChat Pay and Mini Programs.

Key Online Activities & Consumption Trends

Instant messaging, short video, online payment, and online shopping are dominant online activities. Short video and live streaming platforms are primary drivers for online shopping (71% of viewers make purchases after watching). The rapid adoption of generative AI (249 million users) indicates a future where AI-driven content, personalization, and customer interaction will be key competitive advantages.

II. China’s Regulatory Landscape: Cybersecurity, Data Protection & Content Control

The Great Firewall (GFW): Mechanisms and Impact

The GFW is a multi-layered system of legislative actions and technologies that regulates internet censorship, blocking specific foreign websites and slowing cross-border traffic via limited international gateways and Deep Packet Inspection (DPI). Foreign websites accessed from China exhibit significantly poorer performance (e.g., page load times 10.07 times longer than from the EU). This necessitates fundamental adaptation of digital infrastructure and content strategies, as a truly “global” website experience is unachievable.

ICP Filing Framework: Mandatory Requirements

An ICP (Internet Content Provider) license, issued by MIIT, is mandatory for operating websites and applications in China. Foreign businesses must establish a registered legal entity (like a WFOE), host servers within mainland China, and use a .cn domain or one registered through a Chinese registrar. The ICP filing process is rigorous, typically taking 20-40 working days, and all new WeChat Mini Programs now also require ICP filing, solidifying its pervasive requirement across all digital touchpoints.

Cross-Border Data Flow Regulations & Free Trade Zones (FTZs)

China continues to strengthen data governance, enforcing strict personal information protection and cross-border data flow regulations. Simultaneously, it selectively eases restrictions in Free Trade Zones (FTZs) to attract foreign investment and pilot new policies. Foreign businesses should explore FTZ opportunities for more streamlined data operations, while recognizing these are controlled experiments not indicative of nationwide liberalization.

Content Censorship Trends & Sensitive Topics

Content censorship is dynamic and expanding, covering economic discourse and historical narratives. It is becoming more proactive, even targeting private communications. Any content perceived as critical or misaligned with the state narrative faces heightened risk. This requires continuous vigilance and proactive self-censorship from foreign entities, as authorities actively interview platforms and remove accounts/apps for non-compliance.

Emerging Cryptography Standards

China is actively establishing and enforcing its own cryptographic standards (SM2, SM3, SM4, SM9) to achieve digital sovereignty. SM2 SSL certificates are expected to become widespread, with a “dual-certificate system” proposed for simultaneous deployment of international (RSA/ECC) and SM2 algorithms. Foreign businesses handling digital transactions or sensitive data must adapt to these Chinese cryptographic standards.

III. Digital Infrastructure & Website Performance Optimization

Challenges for Foreign Website Accessibility & Load Speed

Foreign websites in China commonly experience slow loading speeds (e.g., 90% take over 1 second to load; 53% of mobile users abandon pages taking over 3 seconds). These delays stem from limited Internet Exchange Points (IXPs), GFW interference, high network latency, and distant servers. This poor performance is a significant barrier to user engagement and conversion, making China-specific solutions essential.

Importance of Local Hosting & China CDN Solutions

Hosting websites in China is crucial for improving performance. China CDN solutions accelerate content delivery by caching content on local edge servers (PoPs), overcoming market entry barriers. An ICP filing is a prerequisite for mainland China CDN solutions. Given China’s unique network architecture and regulatory environment, local hosting and China-specific CDNs are fundamental requirements, not optional enhancements.

Overview of Major China CDN Providers

The China CDN market is rapidly growing, projected to reach US$9,153.9 million by 2030. Major Chinese CDN providers like Alibaba Cloud (37% market share), Huawei Cloud (19%), and Tencent Cloud (16%) dominate the market. They offer superior performance within China due to extensive domestic PoP networks and deep relationships with local ISPs. Foreign businesses must partner with these domestic giants or global CDNs with proven China-specific optimizations.

Website Performance Enhancement Strategies

Optimizing for the Chinese market requires a multifaceted approach:

- Content Optimization: Compress images/videos and minify resources to reduce webpage size.

- DNS Optimization: Minimize DNS lookups, adjust cache times, and use intelligent DNS services.

- Caching: Implement browser caching and utilize CDN’s local caching.

- Eliminate Blocked Content: Remove or modify GFW-blocked content (e.g., Google Fonts API).

- Dual SSL Certificate Deployment: Deploy both international (RSA/ECC) and SM2 algorithms for compliance and compatibility.

IV. Key Digital Marketing & E-commerce Channels for Foreign Brands

WeChat Ecosystem: Mini Programs & H5 Pages

WeChat is China’s primary digital gateway. Foreign brands must integrate deeply through:

WeChat Mini Programs: In-app applications requiring no download, offering performance advantages due to local hosting. All new Mini Programs require ICP filing.

WeChat H5 Pages: Mobile-responsive web pages designed for WeChat’s in-app browser, offering a lower entry barrier.

Tmall Global: Cross-Border E-commerce

Tmall Global, Alibaba’s platform, allows companies without a Chinese entity to sell directly to consumers. Eligibility requires legal registration outside mainland China, trademark ownership, and Chinese content/customer service. It offers a lower entry barrier but demands significant operational localization.

Baidu SEO & Paid Advertising

With Google and other global search engines blocked, Baidu is the dominant search engine in China. Foreign businesses must pivot their search marketing strategies to Baidu, necessitating a deep understanding of its unique algorithms and advertising mechanisms. Without ICP filing, local hosting, and localized Baidu SEO, websites remain invisible.

Digital Platform Content Moderation Services

ICP filing subjects platforms to strict content restrictions. Proactive and continuous content moderation, often by leveraging local services from major Chinese cloud providers, is essential for compliance and mitigating legal/reputational risks due to evolving censorship policies.

V. Strategic Considerations & Best Practices

Addressing Cultural Adaptation & Localization

Many foreign companies fail by underestimating China’s cultural intricacies. True localization goes beyond translation, demanding a deep understanding and adaptation to unique Chinese cultural norms, consumer behaviors, and localized preferences.

Importance of Local Partnerships & Expertise

Local partnerships are strategically imperative given China’s unique digital ecosystem, complex regulatory environment, and deep cultural nuances. They provide critical navigation capabilities for compliance, market access, and operational efficiency.

Navigating Bureaucracy & Compliance

Underestimating Chinese bureaucracy and failing to address compliance issues are major obstacles. Proactive and meticulous adherence to regulations, supported by local legal expertise, is crucial for market entry, sustainable operations, and even successful exit. Non-compliance carries severe and long-lasting consequences.

Data Control & Privacy Implications

China has some of the world’s toughest data laws, impacting foreign digital services. Regulations like PIPL and the Cybersecurity Law mandate data localization and impose strict rules on data collection, storage, and transfer. This necessitates significant architectural adjustments and re-evaluation of global data strategies.

VI. Market Entry & Optimization Recommendations

Phased Market Entry: Start with lower-barrier channels (Tmall Global, WeChat H5) to test the market, then gradually transition to higher-investment strategies (ICP-filed websites, Mini Programs, WFOE).

Comprehensive Compliance Roadmap: Establish a Chinese legal entity, register Chinese domains, use local hosting, and develop robust data governance strategies adhering to PIPL, Cybersecurity Law, and emerging cryptographic standards (SM2).

China-Localized Technical Infrastructure: Host websites/apps in mainland China, implement China CDN solutions (preferably with major local providers), optimize content, eliminate blocked foreign services, and utilize dual SSL certificates.

Ecosystem-Driven Digital Marketing: Prioritize WeChat Mini Programs/H5, leverage Tmall Global for e-commerce, invest in Baidu SEO/advertising, and engage on other Chinese social media (Douyin, Weibo, Xiaohongshu) with proactive content moderation.

Build and Maintain Local Relationships: Cultivate strong partnerships with local entities, empower local teams, and foster positive relationships with government officials to navigate bureaucracy and ensure long-term success.

Conclusion

Success for foreign enterprises in China’s digital market hinges on their ability to understand, adapt to, and integrate within China’s unique digital ecosystem. By adopting these strategic recommendations, foreign enterprises can better navigate China’s complex yet dynamic digital landscape, seize opportunities, and achieve sustainable growth.