Navigating China’s Digital Frontier: Trends, Consumers, and Strategic Imperatives for Western Businesses

China’s digital landscape is a formidable, fast-evolving ecosystem unlike any other. For Western enterprises contemplating market entry or seeking to expand their existing footprint, a nuanced understanding of its unique characteristics, dynamic consumer behaviors, and complex regulatory environment is not merely advantageous—it’s essential. This article distills key insights from recent analyses, offering a strategic overview of how to thrive in the world’s most vibrant digital arena.

The Unrivaled Scale of China’s Digital Economy

The sheer scale of China’s online market is staggering and continues its exponential growth trajectory. Projections indicate the social commerce market alone will reach an astonishing $8.55 trillion by 2033, with China accounting for a dominant 50% of the global market share in 2024. The broader e-commerce market is set to hit $7.45 trillion by 2035, while digital advertising expenditure is forecasted to reach $145.4 billion by 2030. These figures underscore a digital economy that isn’t just large, but fundamentally defines global commerce.

At the heart of this growth are ubiquitous digital platforms. Unlike the fragmented web ecosystems in the West, China operates on a “walled garden” principle, dominated by integrated super-apps like WeChat, Douyin (TikTok’s Chinese counterpart), and Alipay. These platforms transcend mere social media or payment tools, serving as comprehensive ecosystems for social interaction, content consumption, shopping, financial services, and more. For instance, WeChat boasts over 1.4 billion monthly active users (MAUs) as of Q1 2025, with Mini Programs alone attracting close to 945 million MAUs in Q1 2024. Douyin’s e-commerce GMV saw a remarkable 30% year-on-year increase in 2024, reaching approximately 3.5 trillion yuan (around $480 billion USD), with an ambitious target of 4.2 trillion yuan ($580 billion USD) for 2025. This closed-loop nature means Western brands must pivot from independent website models to deeply integrated, platform-native operations.

A Mobile-First, Video-Centric, Socially-Driven Ecosystem

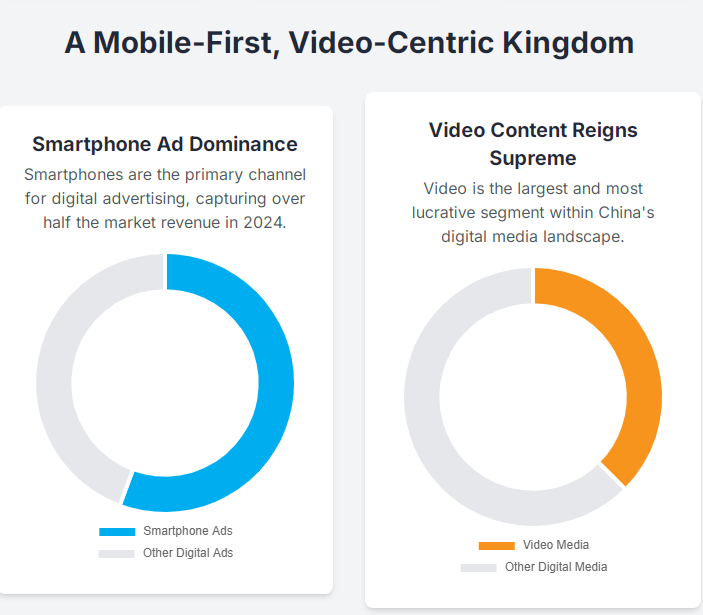

China’s digital sphere is unequivocally mobile-first and visually driven. Smartphones capture a commanding 55.63% of digital advertising revenue in 2024, emphasizing the critical need for mobile-optimized strategies. Video content reigns supreme, constituting 37.51% of China’s total digital media market. This dominance fuels the social commerce revolution, where shopping is intrinsically linked to content consumption and social interaction.

The evolution of Douyin’s e-commerce strategy exemplifies this shift. While influencer-led live broadcasts were once paramount, there’s a clear move towards ‘shelf-based shopping’ and direct ‘merchant self-broadcasts’, which together accounted for over 70% of GMV in 2024. This signals a maturation where brands can build direct, sustainable sales channels within the platform, reducing reliance on top-tier influencers. The rapid expansion of instant retail (O2O) further underscores the demand for immediate gratification, with the market reaching 650 billion yuan ($89 billion USD) in 2023 and projected to exceed 2 trillion yuan ($274 billion USD) by 2030. Platforms like Meituan and JD.com are shaping a “30-minute life circle,” making local, on-demand delivery a consumer expectation.

Decoding the Modern Chinese Consumer

Understanding the nuances of Chinese consumer behavior is pivotal. The market is increasingly defined by consumption stratification and a “value-for-money” mindset, where 47% of consumers report buying only products they will use. However, this prudence coexists with a willingness to pay premiums for specific values: 66% will pay for convenience, 83% demand transparency in ingredients and processes, and 78% are willing to spend more on goods that promote mental well-being or reduce stress. This polarized trend — discount for necessities versus premium for emotional/experiential goods — requires highly targeted product positioning.

Decision-making paths have also been reconfigured. Search behavior is highly socialized, with platforms like Xiaohongshu and Douyin increasingly serving as primary product discovery and review hubs. The demand for an omnichannel experience is paramount, with 85% of consumers preferring a seamless blend of online and offline shopping. This has led to the growth of “miniaturized + fresh food” physical stores, integrating community presence with digital convenience.

Generational differences present distinct opportunities. Gen Z prioritizes “emotional value,” flocking to trendy toys, pet products, and national brands (Guochao) that offer self-expression and mood upliftment. In contrast, the burgeoning silver economy (expected to grow to 30 trillion yuan by 2035) focuses on quality, safety, and functionality, with younger family members often influencing their online purchases in categories like health aids and easy-to-use tech.

Data-Driven Marketing and Emerging Technologies

Navigating China’s digital marketing requires leveraging sophisticated, localized tools. Brands must master ecosystem-specific data analytics platforms like WeChat Domain Data (SCRM), Douyin Cloud Atlas, and Huawei’s HarmonyOS Jinghong Dongneng, which offer deep user profiling across various devices. Third-party monitoring services like Miaozhen Systems and QuestMobile provide crucial cross-platform insights and ROI measurement.

AI is rapidly transforming marketing operations. While AI marketing application is still evolving (around 28% adoption for specific tasks), 41% of advertisers plan to increase their AI usage for efficiency, user insights, and content creation. Generative AI is reshaping content production, powering virtual humans, AI-generated short dramas, and personalized advertising creatives. Predictive user operations, leveraging behavioral data for timely, hyper-personalized marketing, are also gaining traction.

Performance evaluation is shifting from mere GMV to Lifetime Value (LTV), particularly for private domain users. Critically, 73% of enterprises are now directly linking marketing metrics to overall business growth, pushing for a more holistic, integrated approach to brand and performance marketing.

Strategic Imperatives for Western Enterprises

Entering the Chinese digital market demands careful navigation to avoid common pitfalls. Western companies often err by underestimating the complexity of platform rules (e.g., WeChat’s external link restrictions), overlooking high content compliance costs, and misjudging consumer price sensitivity. The Anti-Unfair Competition Law (AUCL) and stringent data regulations (Data Security Law, Personal Information Protection Law) carry significant extraterritorial reach, necessitating explicit user consent, local data storage for critical information, and meticulous content review to avoid censorship or legal repercussions.

A successful channel strategy requires a holistic layout with strategic breakthroughs. For high-penetration categories like beauty and health supplements, a robust KOL (Key Opinion Leader) and self-broadcast matrix within closed-loop platforms like Douyin can drive significant private domain conversions. For high-decision categories such as automotive or home furnishings, leveraging multi-device ecosystems like HarmonyOS offers unparalleled cross-platform reach and information distribution.

Finally, cultural adaptation is non-negotiable. Designing “Chinese-style social currency” involves tapping into local festivals with unique activations (e.g., Lunar New Year red packet customization), and packaging products with emotional value that resonates with local pain points (e.g., health anxiety, parenting challenges).

Looking ahead to 2025-2027, policy levers like “trade-in” subsidies for electronics and home appliances will likely stimulate consumption. The technological explosion will see AI agents become even more deeply involved in consumer decision-making. For Western brands, the immediate action items include strategically leveraging WeChat gifting, Douyin search functionality, and HarmonyOS Lite Apps. Long-term success, however, hinges on building robust localized data infrastructure and continuously adapting to China’s dynamic regulatory environment. The Chinese digital frontier isn’t for the faint-hearted, but for those who understand and adapt, the rewards are immense.